Theory vs. Practice

Diagnosis is not the end, but the beginning of practice.

World Peace Requirements

It might come as a surprise to many, but the obstacles facing "balanced" relationships are always the same, whether

the economy, finance or technology are considered because the only point that matters is "sovereignty

Sovereignty: the full right and power of a

governing body over itself, without any

interference from outside sources or bodies.

You can only be 100% sovereign or not at all:

there is no way to be "partly-sovereign".".

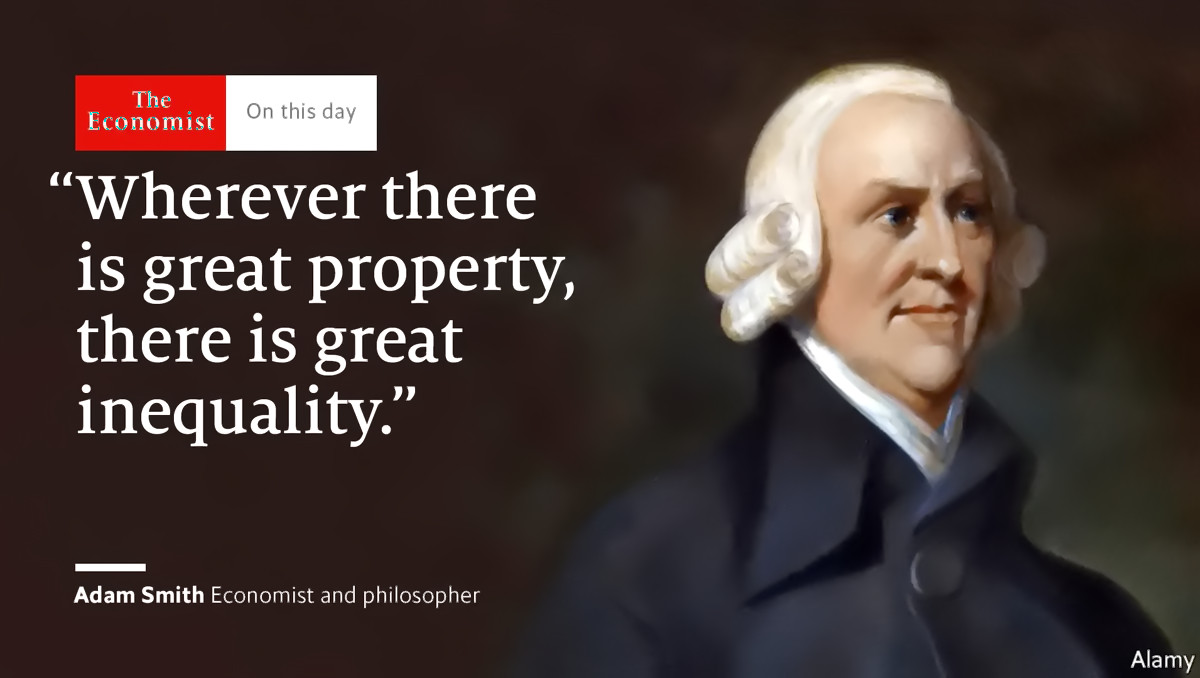

As Adam Smith (Scottish economist, 1723-1790) demonstrated it in "The Wealth of Nations", the "open and free markets" depend on the sane execution of "fair competition" and "Justice"... when self-discipline among government, finance, and merchants is lacking:

I sincerely believe that The Economist's provocative quote of Adam Smith is not the definitive answer to this old and universal problem: opposing the rich and the poor is purposely made to prevent people from spotting what matters, in reality.

Like Adam Smith, I think that market distortions are the problem rather than wealth coming from well-informed customers enjoying real choice (so they can vote with their purchases and promote true value – the core engine of true capitalism). So, in this article, I will present a way to make wealth compatible with sane competition – even in the absence of self-inflicted discipline.

To the credit of Adam Smith, such an option was not available at his time.

1. The Real Problem: Market Distortions

Founded in 1998, TWD has created and sold Remote-Anything (RA) in 138 countries

– without any funding. Customers, ranging from individuals to BigCos and even governments, had plenty of choice but preferred TWDClick on the link and scroll-down on the page

until you see TWD customer testimonials.. Pure capitalism – even when SYMANTEC antivirus products (87% of the market)

deleted RA illegally to protect dying SYMANTEC PCanywhere sales (from 53% of the market): most users have removed their SYMANTEC antivirus

to keep using RA, naturally excluding treachery and rewarding value.

The "free and open markets" worked very well until (1) MICROSOFT Windows deleted RA illegally, (2) the dept. of "Justice" fined TWD

for daring to protest and (3) with the lack of legal sanctions, the demolition team was extended to the whole US-dominated ecosystem

(payments & advertising platforms, media, telecoms, hosting companies, registrars, distributors, resellers, partners...).

Government economic warfare protecting private interests is not part of the definition of

Capitalism.

And it isn't just middle-sized companies:

"The US government has even gone as far as to push companies like AT&T to sever ties with Huawei last year, despite an agreement that the carrier would sell the Mate 10 Pro in its stores. And for all we know, this interference could get worse. Huawei has a plan B if Android ever became unavailable to them. Samsung did the same in the past, developing Tizen specifically in case it had to switch away from Android."

The same market distortions (cutting-off the oxygen) are used to hit nations: big European companies were recently forbidden to sell abroad because of US economic sanctions against Russia and Iran. Under the Charter of the United Nations, these unilateral sanctions are illegal and constitute a forbidden act of aggression... on the top of weakening an already distressed European economy.

Like for the 1789 French revolution caused by the famous (but still censored in French schools) planned "Flour Famine" falsely attributed to the (publicly beheaded) King by the market manipulators to seize his power, "The Visible Hand Of The Market, Economic Warfare In Venezuela"Click the link to download this (very good) free PDF book! written by Venezuelan economist Pasqualina Curcio-Curcio documents how coups (and World wars) are engineered via "planned shortage of essentials goods", "manipulation of the exchange rate and induced inflation", "supply boycott", "covert trade embargo", and "international financial blockade":

"Large transnational corporations are the visible hand of the market, the ones commanding and operating the economic warfare. They own the weapons to boycott the supply of essential goods, to impose trade embargoes, manipulate and induce inflation, and publish rigged country risk ratings. They own the hegemonic mainstream media, whose participation is of paramount importance since they cover up the warfare actions, distract and mislead the people."

The economic nature of the motivations is also clearly exposed:

"The current economic situation Venezuelans are going through result from political actions undertaken by those who want to seize power

of a country that has the largest world oil reserve, the second largest gas reserve, and the largest freshwater reserve, gold and coltan

Coltan's tantalum is used to manufacture

batteries for electric cars, and in tantalum

capacitors it is used in electronic products.

in the world."

If "the markets" allowed Venezuela and Iran to trade their natural resources they would be among the richest nations in the world. There is no other reason behind the suffering of the populations and political chaos, in Europe (notably WWI, WWII) and abroad: Germany's Berlin-Baghdad railway let it trade oil for goods in the Middle-East, and the British Empire decided otherwise.

When the "Rule of Law" is a mockery of Justice, either you take the hit and flee (at your sole expenses) or you start a war (your only recourse). The latter can work if you have a chance to win, and don't hurt your own interests in the first place: (1) the US is one of the largest markets for most products and services and (2) most of its infrastructure and debt is held by... foreigners.

Note: I am not anti-American nor I feel bankers should be jailed. I have worked in the US and have many US friends. As both the US and Europe pursue the same self-destructive path, denial is sterile so I see value in bringing a solution. That's my point because:

A lack of beneficence will make a society uncomfortable, but the prevalence of injustice will utterly destroy it.

Accounting and auditing reforms are a matter of urgency and meaningful action is needed to resolve the current accounting crisis. If we do not accept this challenge, we risk more than the demise of Enron, Arthur Andersen or WorldCom. We place at risk a fundamental underpinning of our market economy.

2. The Very Old Secret Root Single Cause

MS-DOS, and later MICROSOFT Windows, started as fruitful ecosystems which value came from the countless contribution of third-party software publishers. MICROSOFT, well-aware of this, was doing its best at attracting as many developers as possible to leverage the relevance of its proprietary platform enjoying 95% of the Desktop market.

But MICROSOFT is also well-known for its anti-competitive practicesClick to download US Dept. of Justice (DoJ) PDF

"U.S. V. Microsoft: Court's Findings Of Fact".

aimed at harvesting the value created by these third-parties (previously invited and then illegally ransomed

or eradicated). This market sterilizationClick to download MICROSOFT

"internal-use-only" PDF titled

"Evangelism is War".

has led to a loss of value (and innovation) of the platform – without much consequences on their revenues because

end-users have little choice: the Apple, Google and Linux platforms are controlled by the same financial and military interests

– hence the value of suppressing (any real) competition.

How the endlessly funded (by private central-banks, private commercial-banks, and privately-funded States) GAFAM (Google, Apple, Facebook, Amazon, Microsoft) could be threatened by self-funded SMBs?

Again, the answer has nothing to do with Capitalism:

The competition of the poor takes away from the reward of the rich.

If you have reached a dominant position by the use of disloyal means (endless funding, public subsidies, legal and fiscal leniency, public contracts), then you don't want to face challengers that made their way to the top without cheating: you would not last long. But, more commonly, talent is not even required: the sheer number of the poors will suffice to reduce the returns enjoyed by the rich.

The same is true for the world's economy chronically suffering from "diminishing returns" as State-sponsored corporate profits exploded. Like for the economic crises artificially caused by planned money-supply fluctuations, this short-term tactic (of inviting people to cut their throats by night) must be planned and applied periodically to work on the long-term:

It was not by gold or by silver, but by labour, that all the wealth of the world was originally purchased.

This quote is mysterious to most because understanding it requires suppressed knowledge:

Unregulated money creation: when gold and silver coins were in use, the goldsmiths were issuing more paper receipts (accepted for payments) than their customers' metal deposits, a fraudulent practice that flourished on the assumption that only a few customers would withdraw their deposits at the same time (avoiding a deadly event coined later as a "bank run").

The fractional reserves theory came then, (falsely) stating that banks are safer with larger reserves – as they are "only allowed to create money up to a regulated limit" (their reserves should represent 3-9% of the 'loaned' money they create).

Today's financial intermediation theory (even more falsely) states that "banks don't create money and just lend client deposits". This lets banks (falsely) pretend that, as mere intermediaries, they don't have a significant economic impact on the economy.

In reality, "banks as money creators can effectively conjure any level of capital, therefore rendering bank regulation based on capital adequacy irrelevant"[1]. Money creation has no limits – thanks to systemic political and Academic corruption:

"Banks do not gather deposits and then lend these out, as the financial intermediation theory assumes. Nor do they draw down their deposits at the central bank in order to lend, as the fractional reserve theory of banking maintains."[2]

How do these secret "creative accounting" practices relate to Adam Smith's quote about "labour"?

1. Bank loans make the deposits: more than 95% of the total money in circulation comes from bank loans.[2]

2. "Banks newly invent the money that is 'loaned' by creating it out of nothing, a well-established fact."[1]

3. Banks charge interests to "cover the imaginary risk of non-performing loans" created by the stroke

of a pen.

4. Banks decide how much money is lent, given to whom, for what purpose, shaping the World's economy.

5. Banks create economic booms by granting affordable loans to everyone (consumer, business, government).

6. Banks create economic crises by no longer giving any loan (except then to their friends and to themselves[1]).

7. Deposits being debt (#1), as debts are paid off, no money remains for consumption, savings, or investments.

8. Borrowers default on their loans as the amount of money in circulation is simply too small to pay off all the debt.

9. Governments, businesses, and consumers enter into bankruptcy as the whole economy is out of fuel (money).

10. Banks seize loan/overdraft collaterals (mostly tangible assets, in exchange for money created "out of thin air"

[1]).

Wash, rinse, repeat – for centuries planned financial crises transfer tangible assets (people's "labour") to the bankers. Effortlessly: in this system, the only possible way for all debt to be paid is... to create even more credit. Market crashes like hard resets are inevitable (negative interest rates destroy some money to let a few enjoy free loans to reduce their debt while others' savings evaporate – this is yet another wealth transfer – it won't resolve the problem unless negative rates are inflated by several orders of magnitude):

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

Fish growing in an aquarium need a constant supply of food. Cut the supply and they eat each-other. If you give them food again before most died, the group will grow again. To harvest people's home or business, bankers create money and then stop doing it. Government, business, or consumer – we are all trapped into an aquarium – at the mercy of bankers eager to feed us... until they stop doing it.

Created in 1978 by the banker Jeffrey Bell and the Rockefeller Fondation in Washington DC (USA), the "Group of Thirty" (G-30) formulates recommendations for central banks, and major international banks. On the top of the (supposedly sovereign) ECB (European Central Bank) the G-30 decides, without the oversight of anyone, and in the greatest discretion (few have heard about it).

In January 2018 the EU Ombudsman Emily O'Reilly has asked, in vain, the ECB directorate to stop participating to G-30 meetings.

This is how US "Window guidance

Window Guidance: a process by which a central bank

imposes credit growth and allocation quotas on National,

European Union, or US Federal commercial banks.

" imposes its financial policy globally, via the Central Banks network – just like the "official news" are

pushed all over the world via the... occidental News Agencies,

1851: Reuters (Britain), 1846: AP (US Associated Press), 1835: AFP (Agence France Presse, previously Havas):

"With offices in most countries of the world and cover all areas of information, the major news agencies generally prepare hard news stories and feature articles that can be used by other news organizations with little or no modification, and then sell them to other news organizations".

In a similar centrally-controlled organization, the UK's 1689 "Glorious Revolution" (which gave to Parliament the power to control the Queen expenses) created the representative democracy... relying on London-residing politicians more concerned about their London bank account than about the problems of their remote fellows (Wales, Ireland, and Scotland).

This corrupt hierarchy covertly substituted to "democracy" by the world of Finance has been adopted by the USA, France and then progressively by the rest of the world. Resistance is qualified by the media as "undemocratic" and aggressively attacked by illegal unilateral economic sanctions, covert occidental plots to organize State coups, and military wars (when "soft-power" has failed).

Any similarity with the centralized central bank network (organization, birth dates, owners) would be purely fortuitous.

Europe is an extension of this delegation of powers from local bodies to an unelected and unaccountable centralized power.

Call this "democracy" if you can (today's occidental situation is the extreme opposite).

The USA invite you to use SWIFT (and then exclude you from this international interbanking payment platform), they do the same with international NEWS AGENCIES (from which Russia and even US independent bloggers are excluded for not aligning with the US official editorial line), and they threaten to use the INTERNET to take your critical infrastructure down - by the press of a button:

"President Obama approved a previously undisclosed covert measure that authorized planting Cyber weapons in Russia's infrastructure, the digital equivalent of bombs that could be detonated if the United States found itself in an escalating exchange with Moscow." – The Washington Post, June 2017

Anyone spotting a pattern here?

It is not accidental that MICROSOFT and occidental private bankers use the same disloyal traps against the uninformed masses: Bill Gates got $1 million at birth from his grand-father, and his mother was part of an old family of US bankers sitting at the board of BigCos like IBM. MICROSOFT has often destroyed decades of partners' investments (like IBM OS/2) – by just saying that a product APIAPI: Application Programming Interface. reached its EOLEOL: End of Life. (yet IBM did not sue, despite having funded the development of what then became "MS-Windows").

In the same vein, the "GOOGLE DDoS protection" would be useless if GOOGLE's "secure" HTTPS protocol was not designed to be vulnerable to DDoS attacks. And "MICROSOFT AccountGuard" would be pointless if Office 365, Hotmail, and Outlook accounts did not require "improved protection". This is mafiosi "protection": either you "comply" (with whatever they want at any given time) – or you are out of business. No wonder why some happen to reject the "democratic, free and open markets" narrative.

When it relies on the will of one single party, trust can be destroyed by the stroke of a pen:

I am afraid the ordinary citizen will not like to be told that the banks can and do create and destroy money.

The amount of money in existence varies only with the action of the banks in increasing or decreasing deposits

and bank purchases. We know how this is effected. Every loan, overdraft or bank purchase creates a deposit, and every

repayment of a loan, overdraft or bank sale destroys a deposit.

What universities grandiloquently teach as an "Economic Science" is nothing but institutionalized robbery: the well-documented (but kept secret) money-creation private monopoly[1] lets a very few fund any project or purchase (of others' labor) while they chronically deprive competitors from capital. This is a feudal system which disregards talent and merit for the benefit of a tiny number of dynasties.

And even its most distinguished architects describe it as the reign of the waste and arbitrary:

If the Treasury were to fill old bottles with bank notes, bury them at suitable depths in disused coalmines and

leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again there need be no more unemployment

and the real income of the community would probably become a good deal greater than it actually is.

This system falsifies the economy – prevents capitalism from taking place – causes wars and the bankruptcy of Nations.

This also explains why, as the public debt accumulates (instead of being absorbed by a public central bank and via the inflation), taxes are endlessly raised to pay – to private banks – the interests of this public debt (at a rate decided by these same private banks). This is how "income tax" (previously restricted to wartime) was made permanent in 1913, the year the (privately-owned) "US Federal Reserve" was created. In the UK, this was a few years before the creation of the (privately-owned) "Bank of England" in 1694.

The most certain way to expend tax is to raise national spendings (Defense spendings, pointless critical infrastructure) and people's expenses. This can be forced by raising the price of the most basic needs:

energy, water, citizenship and business "compliance" requirements (construction permit, annual car/home norms and inspections, mandatory insurances,

carbon-taxYet another institutional fraud, read the PDF report

"Climate Change Reconsidered II, Fossil Fuels"

by clicking on our link.

, etc.). These non-productive incompressible expenses make everyone poorer – but they artificially raise the State

solvency (legally allowing even larger public indebtedness rates to make the bankers even richer and more in control of the weakened nations).

And there is the all time winner for finance, WAR:

The want of parsimony, in time of peace, imposes the necessity of contracting debt in time of war.

The French "Gilets Jaunes" protest against their reduced living conditions: rising unemployment, ever-shrinking buying-power, public services (basic social programs, healthcare, education, infrastructure...), and disappearing pensions (despite lifetime contributions).

How comes? France is a rich country – and its billionaires are striving like never before! Where does the money go?

France has committed 300 billion euros to beef-up its involvement in (illegal) foreign wars of aggression targeting, among other things, uranium mines in the Sahel that supply French nuclear energy plants. TIP: weapon-makers would go bankrupt without wars... and 70% of the US economy manufactures weapons, which is why US vassals are under the obligation to (1) buy US weapons and (2) launch wars as US proxies.

If France was a democracy, then its population would have decided what to do with the money THEY PAY through taxation. It is doubtful that they would have decided to fund massive killings abroad and Police spying and repression to tame domestic social opposition.

Instead, they would have probably decided to raise the French human-development standards and quality of life through developing the national infrastructure, and to foster employment and commerce through economic and industrial development in Africa. TIP: any candidate for presidency having such a program would be very popular (but most probably not promoted by finance and its largest cash-cow, the military-industrial complex – hence the total lack of such a politician). Representative democracy is not so "democratic" after all.

The example above tells a lot about what exactly the problem is.

Like for any parasitic system, there is a limit to the appetite of the beast: the survival of the host. Without hosts, the parasites can't exist. To prevent such an unfortunate state of things, a major change of the system will force all of us to trade freedom (of speech, entrepreneurship and thinking) for basic survival (think about the bees in a hive... which honey is harvested by the land owners, enjoying a license to kill their property). Pardon me for not seeing this as a great progress for "human civilization".

Created in England, this criminal private central-bank network has been extended worldwide – except (for a long time) in Cuba, Iran, and North-Korea... the three main targets of the unilateral US sanctions. Tell me about the "fairness of the markets" again, if you can.

Yet, recently, the central banks of Cuba, Iran, and North Korea have finally joined this international network of central banks, giving even more credit to the "infiltrate and subvert" tactic used for centuries now. Money (created out of nothing) cannot buy everything, but it certainly helps to promote any agenda.

It is well enough that people of the nation do not understand our banking and monetary system,

for if they did, I believe there would be a revolution before morning.

Henry Ford might have found inspiration in a previous quote:

If the people only understood the rank injustice of our money and banking system,

there would be a revolution before morning.

3. The Only Solution: Escape the Aquarium

Not all bankers on Earth play this nasty game (a few forbid interests, are not-for-profit, offer gold or oil parity for their currency, etc.). But when a majority is aligned then global damages are unavoidable. Further, in today's world, commercial banks are destroyed (negative interest rates, eye-wateringly expensive regulation hitting small banks, etc.) by occidental central banks willing to get a 100% monopoly on the World's money-creation.

So much power in one single hand would cause the end of the freedom to exist for all other parties. Dissent would be eradicated on a

per-person or per-group basis by the press of a

button

Click the link to watch "Princes of the Yen, Central Bank

Truth Documentary", an English economist movie that

has eclipsed "Harry Potter" in Japan.

like it has been done for nations in the past. A dark banker's dream: Global Totalitarianism

Totalitarianism: mode of government which prohibits opposition,

controls the economy, restricts speech, favors mass-surveillance

and widespread use of state terrorism, recognizing no limits to its

authority in any sphere of public or private life.

Any resemblance with exiting States would be purely fortuitous.

.

Our "democratic" occidental institutions and their biased rules serve the interest of the very few against the interests of the many... whose (State-controlled) education has enforced the idea that this farcical system is the "least damaging solution", yet:

Civil government, so far as it is instituted for the security of property, is in reality instituted for the defense of the rich against the poor, or of those who have some property against those who have none at all.

When a centuries-old oligarchy (rather than the people) is controlling finance, government and BigCos, there is no room for Justice.

The solution is obvious: if the rules designed by the elite for the elite are unjust for all others, then let the masses use better rules. What has prevented people from doing so in the past is (1) the lack of real-time communications, (2) the lack of economically-viable model, and (3) the lack of widely-available impenetrable security (yes, it has been done).

Unlike for Adam Smith, these conditions are met today. Today's victims will no-longer have to ask the permission to the oligarchy about if and how they can buy and sell goods and services. And the oligarchy can be excluded from this game: just don't do business with anyone abusing you. As a result, the oligarchy and the poor will be tied by impenetrable security and then enjoy similar protection.

It's not the rich against the poor – it's all about fairness: if you don't play fair then I am no longer obliged to play with you.

The sole use of money is to circulate consumable goods.

Global-WAN's technology can enforce the freedom to trade and the security of assets. No more market distortions, no more spoliations. In a fair game, who do you think will win? The pathological cheaters or the hard-working class?

Questions & Answers

Blockchains

Isn't it what blockchains were supposed to do?

Yes. But, given their total lack of inherent security it is most likely that they were nothing but yet another deception attempt. There are convincing hints from serious sources supporting this idea.

Scrutiny

I am not a security specialist. How can I recognize honest and competent players from government shills and scammers?

Follow the money: the controlled opposition

Controlled opposition: someone who pretends to oppose

the establishment while covertly serving it.

is heavily funded by the usual wrongdoers. Scammers never

delivered in the past (they create a new company, ask for

funding upfront – before delivering anything – rather than as time goes, and disappear).

Trust

Why should I trust TWD?

In proportions, we have probably lost more than most – and we have designed a platform in 2010 to protect our interests, which can only last and strive if your interests are equally protected.

Timing

How could TWD succeed where Nation-States have failed?

"An invasion of armies can be resisted, but not an idea whose time has come." – Victor Hugo (1802-1885), French Author

As the 99% is now feeling the deadly bite coming, they are (or will soon be) looking for a survival solution. Give them a

working alternative to today's sorry state of things and it will become mainstream overnight.

Realism

Why the all-powerful elite would let you do it?

Their cooperation is not needed. And their magic powers (money created out of thin air and State-sponsored backdoors) have no effect on TWD's future-proof "unconditionally-secure" platform.

References

[1] The secret private money-creation monopoly:

"A lost century in economics: Three theories of banking and the conclusive evidence"

Richard A. Werner, 2015

Centre for Banking, Finance and Sustainable Development

Southampton Business School, University of Southampton, United Kingdom

"5.2.1. How to create your own capital: the Credit Suisse case study (emphasis added)

The link between bank credit creation and bank capital was most graphically illustrated by the actions of the Swiss bank Credit Suisse in 2008.

This incident has produced a case study that demonstrates how banks as money creators can effectively conjure any level of capital, whether directly or indirectly, therefore rendering bank regulation based on capital adequacy irrelevant.

Unwilling to accept public money to shore up its failing capital, as several other major UK and Swiss banks had done, Credit Suisse arranged in October 2008 for Gulf investors (mainly from Qatar) to purchase in total over £7 billion worth of its newly issued preference shares, thus raising the amount of its capital and thereby avoiding bankruptcy.

A similar share issue transaction by Barclays Bank was 'a remarkable story of one of the most important transactions of the financial crisis, which helped Barclays avoid the need for a bailout from the UK government'. The details remain 'shrouded in mystery and intrigue' (Jeffrey, 2014) in the case of Barclays, but the following facts seem undisputed and disclosed in the case of Credit Suisse, as cited in the press (see e.g. Binham et al., 2013).

The Gulf investors did not need to take the trouble of making liquid assets available for this investment, as Credit Suisse generously offered to lend the money to the Gulf investors. The bank managed to raise its capital through these preference shares. Table 11 illustrates this capital bootstrapping (not considering fees and interest).

Table 11 How to create your own capital: Credit Suisse in 2008. £bn. Step 1: Loan to Gulf Investor Assets Liabilities Deposits............... + 7 Loan and Investments.... + 7 Capital + 0 Total................. + 7 Total............... + 7 Step 2: Capital Raising: A Liability Swap Assets Liabilities Deposits............... + 0 Loan and Investments.... + 7 Capital + 7 Total................. + 7 Total............... + 7

Since it is now an established fact that banks newly invent the money that is 'loaned' by creating it out of nothing, the loan to the Gulf investor created (in step 1) a simultaneous asset and liability on the bank's balance sheet, whereby the customer's borrowed money appears as the fictitious customer deposit on the liability side, of £7bn.

Considering the same change in step 2, but now after the liability swap, we see that the newly issued preference shares boost equity capital: They are paid for with this fictitious customer deposit, simply by swapping the £7bn from item 'customer deposit' to item 'capital'.

Credit Suisse is then able to report a significant rise in its equity capital, and hence in its capital/asset ratio. Where did the additional £7bn in capital come from? Credit Suisse had lent it to the investor, using its own preference shares as collateral, and hence had invented its own capital.

The risk to the borrower was also limited if the Credit Suisse shares, not other assets, served as collateral.

As has been pointed out (Werner 2014c), in the UK such actions would be illegal, as they violate Section 678 of the Companies Act 2006 (Prohibition of assistance for acquisition of shares in public company). However, the Swiss regulators were happy to tolerate this.

The transgression is clearly graver in the case of a bank, compared to an ordinary firm lending to an investor to purchase the firm's shares: Credit Suisse had not merely lent a prospective shareholder the funds to buy its shares, but it created the funds out of nothing.

A very similar transaction involving similar amounts and also Qatar as investor is alleged to have been undertaken by Barclays Bank in the UK, allegedly also involving an upfront 'fee' paid to Qatar of £322m, which could be a refund of the interest on the loan.

The role of interest is a topic not discussed in detail in this article. In such a transaction, Barclays would likely need to charge interest on the loan, in order for it to appear as a regular deal. If the Gulf investor was acting as a strawman for what amounts to an internal accounting exercise to create the bank's own capital out of thin air, a part or all of this fee could have been the refund of the interest on the loan, so that the investor would not even have to pay interest for receiving the newly created money and with it the preference shares.

According to analysts at Italian bank Mediobanca, such bank loans to new bank share investors were a 'fairly common practice... during the crisis', whereby Credit Suisse may have been unusual in disclosing this and obtaining regulatory approval. Either way, banks in this way created their own capital out of nothing, thus making nonsense of capital adequacy regulations.

We learn from this that under the right circumstances it is possible even for an individual bank to show almost any amount of capital to regulators. It is even more easily possible for the whole banking system collectively to do likewise, without directly contravening the Companies Act. Since during boom times an increasing amount of money is created by banks (hence the boom), some of that can be siphoned off by banks to bolster their capital by issuing new equity.

The regulators seem unaware of this fact, as their descriptions of banking reveal them to be adherents of the erroneous financial intermediation theory of banking."

[2] The secret 'creative accounting' giving super-powers to occidental banks (and the "erroneous" Academic narratives):

"How do banks create money, and why can other firms not do the same?"

Richard A. Werner, 2014

Centre for Banking, Finance and Sustainable Development

Southampton Business School, University of Southampton, United Kingdom

Summary (chosen excerpts):

No law, statute or bank regulation explicitly grants banks the right (usually considered a sovereign prerogative) to create and allocate the money supply. As a result, many economists, finance researchers, lawyers, accountants, even bankers, let alone the general public, have not been aware of the role of banks as creators and allocators of the money supply.

For firms without a bank licence, the disbursement of the loan is from funds elsewhere within the firm.

Thus there is an equal reduction in balance of another account from which the lent funds came from. [...]

Instead, the bank simply re-classified its liabilities, changing the 'accounts payable' obligation arising from the bank loan

contract to another liability category called 'customer deposits'.

While the borrower is given the impression that the bank had transferred money from its capital, reserves or other accounts to the

borrower's account (as indeed major theories of banking, the financial intermediation and fractional reserve

theories, erroneously claim), in reality this is not the case.

The bank's liability is simply re-named a 'bank deposit'. However, bank deposits are defined by central banks as being part of the official money supply (as measured in such official 'money supply' aggregates as M1, M2, M3 or M4). This confirms that banks create money when they grant a loan: they invent a fictitious customer deposit, which the central bank and all users of our monetary system, consider to be 'money', indistinguishable from 'real' deposits not newly invented by the banks. Thus banks do not just grant credit, they create credit, and simultaneously they create money.

Bank credit creation does not channel existing money to new uses. It newly creates money that did not exist before and and channels it to some use... What makes this 'creative accounting' possible is the other function of banks as the settlement system of all non-cash transactions in the economy. Since banks work as the accountants of record – while the rest of the economy assumes they are honest accountants – it is possible for the banks to increase the money in the accounts of some of us (those who receive a loan), by simply altering the figures. Nobody else will notice, because agents cannot distinguish between money that had actually been saved and deposited and money that has been created 'out of nothing' by the bank.

What enables banks to create credit and hence money is their exemption from the Client Money Rules. Thanks to this exemption they are allowed to keep customer deposits on their own balance sheet. This means that depositors who deposit their money with a bank are no longer the legal owners of this money. Instead, they are just one of the general creditors of the bank whom it owes money to.